Exploring your financial services marketing options? You’re not alone. Prospective customers will soon be spending as much as 80 percent of their buying journey in digital channels, per Gartner research, and those in the financial services industry are well poised to meet them there. As someone with extensive expertise in digital marketing for financial services, I’ve been helping companies adapt to the changing times and build thriving companies for decades. I welcome the opportunity to help your financial services company level up, too.

The Role of a Marketer in Shaping the Future of the Financial Services Industry

In the rapidly evolving financial services sector, marketers play a crucial role in navigating the digital landscape. They are tasked with leveraging digital marketing tools to reach new audiences and engage existing clients effectively. Financial marketers focus on developing innovative digital marketing strategies that highlight the unique offerings of financial companies, using best practices to ensure a robust digital presence. By integrating new and inspiring ideas, marketers can help financial services businesses adapt to changes in consumer behavior and technology. This approach enhances customer engagement and strengthens the brand’s position in the market. Financial services marketers must stay informed about emerging trends and technologies, using insights from digital marketing experts to drive their strategies forward.

How Financial Companies Can Leverage the Digital Landscape for Success

In today’s digital world, financial companies must adapt to technological changes and leverage them strategically for success. Building a robust digital strategy that incorporates elements like SEO, content marketing, and social media is crucial. North American financial brands have demonstrated the power of personalized marketing, harnessing digital tools to create deeper connections with clients.

A full-service digital marketing agency offers companies the flexibility to engage clients across multiple platforms, enhancing their digital marketing and experience. Financial services firms can build lasting business partnerships that foster long-term loyalty by understanding their audiences’ unique needs. As companies look toward their futures, collaborating with digital marketing experts from top institutions can help navigate the future of digital marketing and stay competitive in an evolving marketplace.

Digital Marketing Tips for Financial Services to Drive Results

Navigating the current digital marketing landscape is essential for financial institutions looking to engage and retain clients effectively. One of the best digital marketing tips for financial services is to prioritize strategically focused content that addresses the unique needs of their audience. With a shift toward online engagement, financial firms must develop a content strategy that not only educates but also builds trust. This means crafting targeted blog posts, eBooks, and guides that address specific financial questions or concerns, while also leveraging customer relationship management (CRM) tools to personalize user experiences based on data insights.

Mobile marketing is also crucial in the finance industry as customers increasingly rely on mobile devices to interact with financial brands. Ensuring that content is mobile-friendly and accessible across devices can drive more traffic to your website and improve overall user satisfaction. In addition, incorporating CRM platforms helps financial services to monitor client engagement effectively, enhancing the personalization of marketing campaigns.

Integrating these digital marketing tips into your strategy can help financial institutions reach their target audience efficiently. From personalization through CRM to focusing

on mobile accessibility, these approaches collectively support strong, strategically focused content that positions your brand as an industry authority while driving measurable results.

Using AI and Content Marketing to Build Trust and Drive Engagement in Financial Services

In an environment conducive to forging lasting business partnerships, financial companies should strategically focus on creating valuable content that resonates with their audience. By leveraging data analytics and a data-driven approach, they can better understand their clients’ needs and interests, allowing them to customize their products and services effectively. Crafting SEO strategies that drive organic traffic and using AI tools to enhance user experience will help reach potential clients actively searching for financial products. Financial institutions can boost their marketing efforts by providing content that addresses their audience’s pain points, ultimately building trust and generating new leads.

Essential Metrics for Financial Services Digital Marketing Success

For financial firms to achieve success in annual digital marketing for financial services, it’s essential to track specific metrics that align with core business objectives. Key metrics include customer acquisition cost (CAC), which helps financial institutions understand how much they’re spending to gain each new customer, and customer lifetime value (CLV), which reveals the long-term revenue potential of each client. By tracking these alongside other critical metrics, such as conversion rates and engagement levels, financial firms can assess whether they are meeting their marketing goals efficiently.

Moreover, with the increasing complexity in the marketing field, financial institutions must also keep a close eye on metrics like organic traffic growth and click-through rates (CTR)

from SEO efforts. These provide insights into how well content resonates with potential clients and how effectively it attracts relevant traffic. Monitoring these metrics allows financial services to make informed adjustments that maximize marketing ROI and traffic to your website.

Utilizing data-driven insights helps financial institutions achieve a comprehensive understanding of their digital marketing impact. By focusing on these KPIs, financial services providers can effectively measure campaign success, optimize strategies, and stay competitive in the current digital marketing landscape.

Financial Services Companies That Benefit from Working with a Digital Marketing Consultant

Most financial services companies can benefit from working with a digital marketing consultant. However, getting insights from an outside perspective may prove invaluable if you operate one of the following financial institutions.

Banks

Smaller banks and credit unions face multiple challenges, from competing against large corporations to identifying which customers are most likely to sign up for specific services and reaching them with messaging that resonates. As an experienced consultant who has helped Fortune 100 companies dominate their market, I can help your bank stand out and ensure you’re maximizing ROI, too.

Factoring Companies

One of the major issues factoring companies face is that their ideal clients don’t always know their service exists or how it benefits them over other funding options. With this in mind, I typically find that factoring companies grow best by expanding their focal audience and educating business owners who aren’t necessarily looking for invoice factoring, but may be looking for funding or want to address other issues that factoring solves.

Insurance Companies

The internet and mobile device apps have created a whole new insurance sales process. No more are customers calling insurance companies for a lengthy quote process—they’re answering a few questions online to get a quick quote and making the jump faster than ever. Because my experience includes educating Google Partners, I can help ensure your insurance company attracts leads that are ready to take action and boost conversions in a cost-effective way.

Financial Advisors

If you’re sourcing leads from large advisory networks, you know all too well how expensive that can be. I help financial advisory firms build brand awareness and become established as an authority, so prospects develop trust organically and leads can be captured for a fraction of the cost of other channels.

Marketing Leaders in Financial Companies: Shaping Tomorrow’s Success

Marketing leaders in the financial services sector face the challenge of keeping pace with rapidly evolving trends. Their role goes beyond campaign execution; they are responsible for shaping a company’s vision and implementing a digital content strategy that drives growth. Events like the Financial Services New York Summit and the annual DMFS Canada Summit offer these leaders the opportunity to learn from digital marketing experts from top Canadian firms.

By adopting innovative digital marketing solutions and staying informed on the latest digital marketing tips, these leaders are better equipped to position their companies for success. Marketing for financial services involves understanding the present landscape and anticipating future trends to ensure growth. The ability to adapt and incorporate best practices will define the future success of financial brands.

Financial Services Digital Marketing Strategies

Though an independent business and marketing consultant, I work with all the digital marketing strategies a traditional digital marketing agency might use and apply proprietary techniques to improve the effectiveness of my initiatives. A few approaches that are typically included in my marketing plans are outlined below.

Digital Marketing for Financial Services

- Search Engine Optimization (SEO)

- Email Marketing

- Online Advertising and Pay Per Click Ads (PPC)

- Social Media Marketing (Instagram, Facebook, LinkedIn, Twitter etc.)

- Content Marketing (Blog, Articles, Case Studies, etc.)

- Online Reputation Management

- Conversion Optimization

Leveraging Marketing Budgets for Maximum Impact in Financial Services

Maximizing the impact of marketing budgets requires strategic planning and prioritization. Financial services leaders overseeing digital marketing strategies should focus on allocating resources to initiatives that align with their company’s goals and deliver measurable results. By investing in full-service digital solutions, financial companies can cover a broad range of marketing objectives, from enhancing brand awareness to driving conversions. Digital marketers can offer guidance on the best practices for budget allocation, ensuring that spending is efficient and effective. Engaging in marketing conferences and event series designed for financial services can provide valuable insights into optimizing marketing budgets and staying informed about industry trends.

Four Digital Marketing Tactics Financial Services Businesses Should Apply

If you’re trying to attract new customers or increase engagement, include the following four tactics in your strategy.

1. Influencer Marketing

People often think of influencer marketing as getting celebrities to endorse your brand. While that may be true some of the time, modern influencer marketing is often done on a macro

scale. For example, if you run a factoring company and want to attract truckers, you may want to work with a podcaster or YouTuber that covers general tips for truckers.

2. Chatbot Marketing

The use of chatbots in financial marketing is often overlooked, but they can be hugely beneficial. Some businesses use chatbots with AI to engage with prospective customers and pitch services, while others simply walk customers through their options based on a list of predetermined responses.

3. Marketing Automation

There are many applications for marketing automation. Most notably, it’s great for collecting leads, nurturing leads, and onboarding new customers.

4. Social Selling

Social selling is less about selling and more about developing relationships. When you engage in social selling, you generally share helpful conversion-oriented content to create lasting connections with people who could benefit from your products or services.

Digital Marketing Innovations in Financial Services

In the digital landscape, financial services companies are finding new opportunities to connect with their audience through innovative digital marketing strategies. As we navigate through the latest digital marketing trends, it’s crucial for marketers in the financial industry to adapt and stay ahead of the competition. By leveraging social media platforms, SEO, and content marketing, we can engage potential customers in meaningful ways, enhancing the customer journey and fostering loyalty.

Digital marketing for financial services goes beyond traditional marketing campaigns; it’s about creating an experience that resonates with new and existing customers, driving conversion rates, and ensuring visibility in a crowded digital space. Financial service providers, from banks to financial advisors, must harness the power of digital channels, including AI and email marketing, to personalize the message and cater to the unique needs of their target audience.

With a robust digital marketing plan that includes the latest trends and strategies, financial organizations can master digital marketing, improving their online presence and customer

experience. Whether it’s through social media content that engages, SEO that boosts organic search visibility, or email campaigns that personalize the customer experience, the goal is to help financial services firms survive and thrive in the digital age. By focusing on customer loyalty, innovative solutions for financial services, and a strategy that embraces digital financial trends, marketers can help their financial institutions stand out and secure a successful digital future.

Adapting Financial Marketing Strategies for the Era of Digital Transformation

The digital transformation era offers financial services brands unparalleled opportunities to redefine marketing strategies. Digital marketing leaders in finance leverage innovative tools and insights to enhance customer experiences. By embracing digital analytics, marketers uncover actionable data that drives informed decisions and maximizes campaign efficiency.

Events like the Financial Services Summit and DMFS New York Summit provide platforms for finance marketers to collaborate, share ideas, and identify trends. These events emphasize aligning marketing and sales efforts to build cohesive strategies across the financial services industry. Representatives from institutions like First Command Financial and Mitsubishi HC Capital Canada benefit from networking opportunities and workshops offering practical insights.

Content creation is critical in financial marketing programs. Educating audiences about services through engaging materials builds trust and fosters loyalty. Utilizing AI and automation streamlines operations, ensuring efficient resource allocation and adaptability. As digital marketing trends evolve, integrating personal financial education and leveraging strategies from leading digital marketing initiatives strengthens connections with audiences.

By adopting strategies aligned with digital transformation, financial services companies can enhance their competitive edge, expand their reach, and achieve sustained growth in a dynamic marketplace.

Reasons to Hire a Digital Marketing Strategist for Financial Services

As an online marketing specialist, I can help your financial services company excel in many ways. Depending on your goals, you can:

- Improve your financial services digital marketing online presence.

- Effectively manage your financial services digital marketing brand.

- Improve your digital marketing for financial services ROI.

- Get measurable financial services digital marketing results.

- Identify your high-value clients in the financial services industry.

- Tap into a one-stop digital marketing consulting for businesses in the financial services industry.

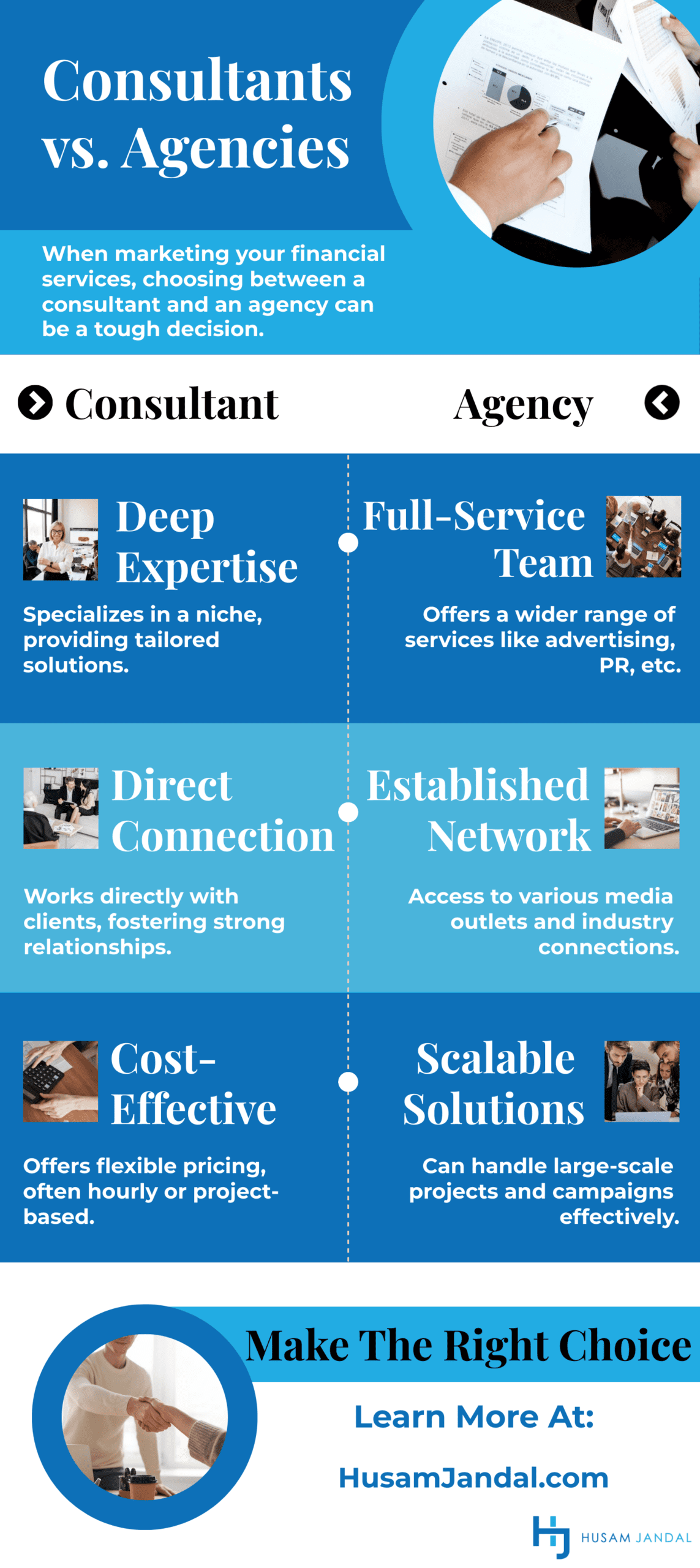

Disadvantages of Hiring a Financial Services Marketing Agency

Although it may sound like working with a consultant and hiring a financial services marketing agency are the same, the process and results are night and day.

- To achieve results, you’ll need to work with specialized resources. Most agencies are generalists.

- High-quality marketing draws on a variety of skill sets. Even agencies that are highly proficient in one area usually lack in another, but they still try to keep all the work in-house anyway.

- It’s best to keep the marketing control at the heart of the business—with people who know your clients and business. Agencies will always have distance and may not make decisions that honor your philosophies.

Your Tailored Marketing Strategy for Financial Services

When I begin digital marketing for financial services companies, I tailor my approach to the business and its needs. However, each plan is built around the same following pillars.

Discovery/Consult

The first step is always a complimentary consultation. I’ll discuss your company and goals with you to identify areas of opportunity and give you a chance to get to know me and my philosophies a bit better.

Competitor Analysis

When you’re ready to move forward, I’ll start digging into your competitors. Although we won’t dwell on their processes too much, it’s helpful to learn what they’re doing to ensure we capitalize on any opportunities they’re missing.

Demographics and Personas

Next, we’ll explore who your current and ideal customers are, then develop personas around them. These personas will make creating content that speaks to your audience easier as we move forward.

Digital Marketing Roadmap

Rather than deploying a comprehensive financial services marketing plan all at once, we’ll roll it out a little at a time. This ensures a smoother transition and better resource allocation, plus allows your company to roll some of your new revenue into future marketing endeavors. Your complete roadmap will likely include:

- Video Production

- Pay-Per-Click (PPC)

- Search Engine Optimization (SEO)

- Development

- Digital Marketing Management

- Analytics

- Social Media Marketing

- Email Marketing

- Copywriting

Talent Sourcing

While many agencies specializing in digital marketing for financial services companies will insist on outsourcing your marketing team, I prefer a tempered approach. For example, if you already have a blogger on staff who knows the medium well and can write equally well for search engines and people, I will likely recommend that you keep this person in their current position. If not, then we’ll explore whether it makes more sense to bring someone on or if it’s better to outsource the role.

We’ll go through each of the duties and jobs outlined in your roadmap and perform the same evaluation. Chances are, you’ll have a team that’s a mix of in-house and outsourced talent in the end, as it’s often cost-prohibitive and less effective to have professionals like developers and SEO specialists as part of your in-house team.

Implementation

With the roadmap complete and the right people in place, we’ll begin deploying your strategy. Keep in mind that certain aspects, like PPC advertising campaigns, will begin producing results before areas like SEO, so you’ll see incremental results as we move forward.

Results, Monitoring, and Building

What happens after implementation is equally as important as what happens beforehand. I’ll keep tabs on your results and make refinements to improve your results even more over time.

Schedule a Complimentary Consultation for Your Financial Services Business

Although my experience in the financial services industry extends through multinational corporations, I prefer to work with small and mid-sized companies that are as eager to produce results as I am. If this sounds like you, let’s talk. Contact me for a complimentary consultation.

Frequently Asked Questions About Digital Marketing Strategies for Financial Services

How Can Financial Institutions Build Customer Trust Through Digital Strategies?

Building customer trust is essential for financial institutions in the digital age. By focusing on transparency, personalized communication, and consistent messaging, companies can strengthen their relationships with clients. Digital strategies such as secure online platforms, customer education initiatives, and clear data privacy policies help establish credibility. Combining these efforts with value-driven marketing ensures financial brands can foster loyalty and stand out in an increasingly competitive industry.

What Role Do Marketing Conferences Play in Shaping Financial Services Strategies?

Marketing conferences are important for financial services firms looking to innovate and refine their strategies. Events such as the DMFS New York Summit provide a platform for exploring different ideas, learning from case studies, and accessing actionable insights from industry leaders. These conferences emphasize strategic planning, showcasing how to integrate analytics, personalization, and emerging technologies into campaigns. The blend of workshops and expert-led sessions ensures that attendees leave with tools and knowledge to elevate their financial marketing efforts in a rapidly changing landscape.

How Can Financial Services Firms Effectively Use Social Media Ads to Reach the Right Audience?

Marketing in financial services requires a strategic approach to social media ads. By leveraging data-driven targeting, financial firms can ensure their ads appear to users who are likely to be interested in their services. Optimizing ad content for the search engine results page and using A/B testing can improve engagement and conversion rates across multiple channels.

What Are the Key Challenges in Marketing for Financial Services?

Marketing for financial services comes with constraints and challenges, including strict industry regulations, evolving consumer trends, and increased competition. To succeed, firms must develop a business strategy that balances compliance with innovative digital marketing efforts, such as targeted social media ads and localized SEO strategies.